For this solution, the partner is responsible for splitting the funds at source. The partner will then send one transfer per merchant to YouLend per day.

Good to knowThis option is currently only available for partners operating in the UK and EU

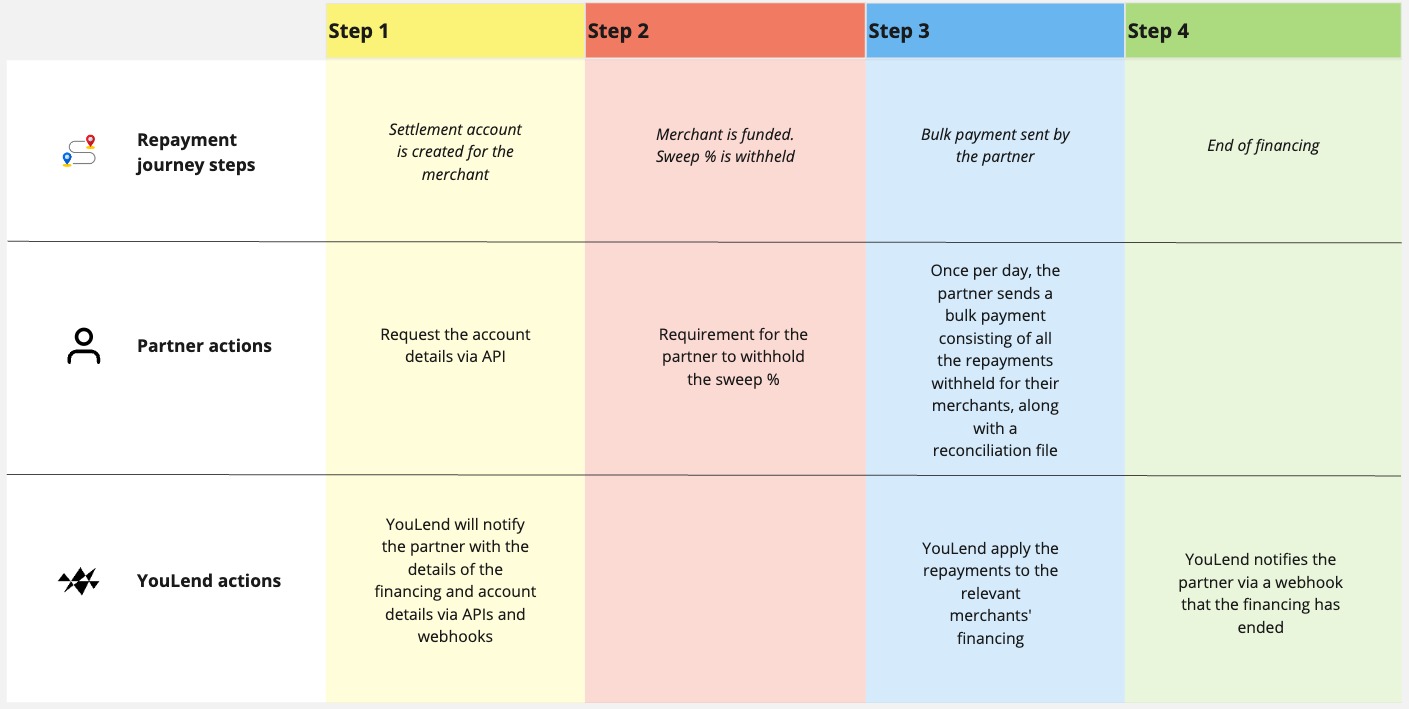

Repayment journey

- When a merchant is funded, YouLend will create a virtual account (settlement account) in the name of that merchant.

- YouLend will notify the partner with the details of the account (either via API or offline).

Example response from the AOL endpoint

[

{

"iban": "DK7389000112017272",

"virtualIban": "DK8389222292389284",

"secondaryVirtualIban": "GB85SAPY62838292389284",

"accountName": "Test Company Limited - SXP Settlement - GBP",

"currencyISOCode": "GBP",

"accountOpeningLetter": {

"documentId": "7fd7c2b5-37fc-4df8-a710-dbfbf5a5cef1",

"document": "JVBERi0xLjYKJeLjz9MKMjI",

"documentName": "Test Company Limited - Account Opening Letter.pdf",

"documentType": "application/pdf"

},

"domesticAccountNumber": "92389284",

"domesticSortCode": "628382",

"partner": "Test Account",

"swift": "SXPYDKKK",

"thirdPartyCustomerId": "89ab144"

}

]

Good to know

virtualIbanandsecondaryVirtualIbanhave the same destination, the difference is thatvirtualIbanis typically a DK IBAN, and thesecondaryVirtualIbanis typically GB. Partners can decide if they wish to send international, or domestic repayments

Example payload from the ONB10035 webhook event

ONB10035 webhook event{

"EventCode": "ONB10035",

"Message": "The Settlement/Repayment account details are ready to fetch from the AOL endpoint to begin the re-routing process",

"EventProperties": {

"LeadId": "f926dgc2-30r6-4721-89c7-2a3f21dfa380"

}

}- Partner build logic on their system to withhold the sweep % when sales are made.

- Once per day, the partner sends the withheld funds to YouLend. One payment per account, one account per merchant.

- YouLend then retain 100% of these funds when there is a balance owing for this merchant. Throughout the financing, the current balance is available to the partner viaAPI.

- At the end of the financing, the partner should stop withholding funds. YouLend will notify the partner via a webhook that the financing has ended. If required, YouLend will return any overpayments to the merchant.

Example payload from the LOA10032 webhook event

LOA10032 webhook event{

"EventCode": "LOA10032",

"Message": "The merchant has repaid the loan",

"EventProperties": {

"LoanId": "f926rfc2-30b6-4821-89c7-2a3f11dda380",

"LeadId": "f926dgc2-30r6-4721-89c7-2a3f21dfa380"

}

}Example transaction breakdown and funds sent

| Type | Data |

|---|---|

| Sweep % | 10% |

| Sales | £500 |

| Refunds | -£100 |

| NET | £400 |

| Sent to YouLend | £40 |

| Sent to merchant | £360 |

| Pros | Cons |

|---|---|

| Removes the requirement for an SFTP reconciliation file to allocate the repayments | This solution isn't currently available for the US. YouLend is looking at introducing this repayments solution to the US in 2025 |

| Seamless customer journey with no change to their payout account for the funds not owed to YouLend | Build required from partners to calculate the sweep |