For this solution, YouLend are responsible for splitting the funds. This solution requires no development work from the partner because no calculation of the sweep or withholding of funds needs to take place at the partner level.

This rerouting approach is the standard method we use across all our UK payment processing partnerships. It’s also widely adopted for routing payments from acquirers we’re not partnered with.

There are 3 ways that this can be adopted:

- Offline process, arranged by merchant

- Offline process, arranged by Partner and YouLend

- Automated process powered by API

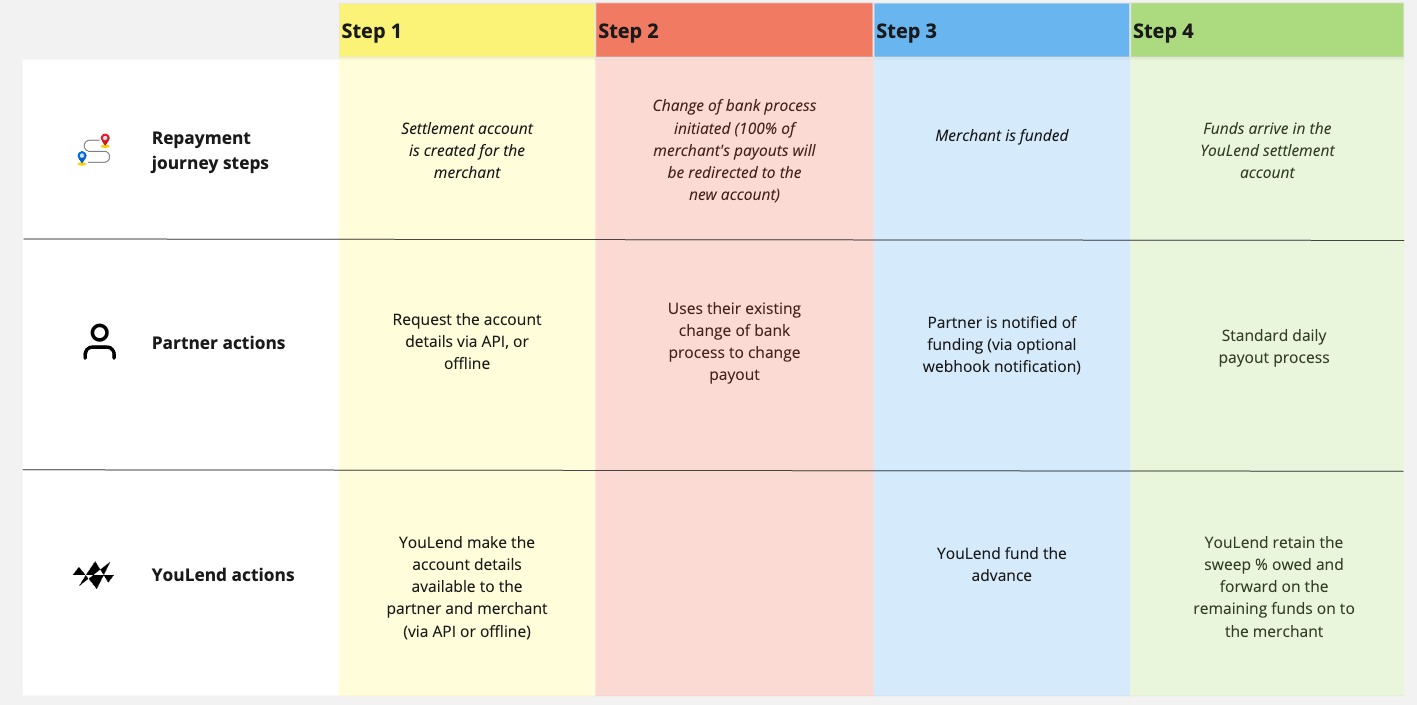

These solutions all work identically after a merchant is funded, the differences are entirely in the set up. After a merchant is funded the flow is:

- Each day, the merchant's payout from the partner gets sent to the YouLend virtual accounts (one payment per account, one account per merchant).

- When funds reach this account, YouLend will retain the sweep % owed and forward the remaining funds on to the merchant immediately.

- Merchants can track their settlements via their YouLend dashboard, which clearly displays daily sales, repayments, and amounts settled. (See attachment.)

Good to knowThis option is currently only available for partners operating in the UK and EU

Offline process, arranged by Partner and YouLend

This is our most common approach for non-integrated or minimally integrated partners. It requires no technical development and minimal operational effort from the partner, while providing a smooth merchant experience.

Operational procedure for funding

- Merchant is approved for funding

- YouLend notifies partner via a dedicated email inbox, sharing merchant details and the relevant YouLend virtual account.

- YouLend disburse the funds

- Partner change the payout bank account for the merchant within 24-48 hours

Offline process, arranged by merchant

This option is used when our partner lacks the resources to assist directly, or when rerouting flow from a non-partner acquirer.

Operational procedure for funding

- Merchant is approved for funding

- YouLend provides merchant with a virtual account and instructions for updating their partner payout

- Merchant completes the update

- Partner processes the change via their standard change of bank process

- YouLend receives settlement from the next batch

- YouLend disburses funds

Automated process powered by API

- Merchant is approved for funding

- YouLend will notify the partner with the details of the account via API

Example response from the AOL endpoint

[

{

"iban": "DK7389000112017272",

"virtualIban": "DK8389222292389284",

"secondaryVirtualIban": "GB85SAPY62838292389284",

"accountName": "Test Company Limited - SXP Settlement - GBP",

"currencyISOCode": "GBP",

"accountOpeningLetter": {

"documentId": "7fd7c2b5-37fc-4df8-a710-dbfbf5a5cef1",

"document": "JVBERi0xLjYKJeLjz9MKMjI",

"documentName": "Test Company Limited - Account Opening Letter.pdf",

"documentType": "application/pdf"

},

"domesticAccountNumber": "92389284",

"domesticSortCode": "628382",

"partner": "Test Account",

"swift": "SXPYDKKK",

"thirdPartyCustomerId": "89ab144"

}

]

Good to know

virtualIbanandsecondaryVirtualIbanhave the same destination, the difference is thatvirtualIbanis typically a DK IBAN, and thesecondaryVirtualIbanis typically GB. Partners can decide if they wish to send international, or domestic repayments

Example payload from the ONB10035 webhook event

ONB10035 webhook event{

"EventCode": "ONB10035",

"Message": "The Settlement/Repayment account details are ready to fetch from the AOL endpoint to begin the re-routing process",

"EventProperties": {

"LeadId": "f926dgc2-30r6-4721-89c7-2a3f21dfa380"

}

}- Partner change the payout bank account for the merchant within 24-48 hours

- YouLend disburse the funds